What is gearing, and how to use it to make more money. Do you have a lot of capital tied up in your home, or another property? Did you know that you could use that capital to make more money? The focus will be on the individual and specifically property.

Let’s talk about how.

What Is Gearing, And How Does It Work?

Gearing is simply the use of debt to facilitate an investment.

This can be either a business that would take on the debt, or an individual.

In both cases they are looking to use that debt to purchase something that will increase in value, making them more money in the future.

We are focussing on the individual and property but the following principles can work for other investments and in business.

Firstly, most people do not feel comfortable taking on debt, and that’s fine. Gearing doesn’t work for everyone, and you have to feel comfortable with what you are doing.

Here’s how it works:

Imagine you buy a new home today that is worth £300,000, you have a deposit of 10%, £30,000, and so you need a mortgage of £270,000. Click here for more on mortgages.

We then jump forward 2 years. Now the property value has gone up from £300,000 to £350,000. Your mortgage has naturally decreased with your monthly payments and now you’re left with £265,000. How much equity do you have in your home?

Well, £350,000 – £265,000 = £85,000. That’s an increase of £55,000 over 2 years.

You now have 2 options.

Option 1:

You can leave everything the same and bask in the glory of having more money in your home.

Option 2:

You could increase your mortgage amount and take some of the capital made and invest it.

Using the first example, imagine you want to retain 10% equity in your home. What would that look like?

We want to find out the difference between the current mortgage amount and the future mortgage amount: £350,000 (current price) * 10% = £35,000 (equity to remain).

£350,000 – £35,000 = £315,000 (new mortgage).

£315,000 (new mortgage) – £265,000 (old mortgage) = £50,000.

£50,000 is the amount of money that can be withdrawn.

This is all subject to mortgage affordability. Click here for the Straightforward Money mortgage payment calculator.

And here for a mortgage affordability calculator.

How To Use It To Make More Money

Making money from the above is relatively simple.

Below is an example of how you can better use £100,000 with gearing. It is a simple example but can be scaled up or down depending on the funds available.

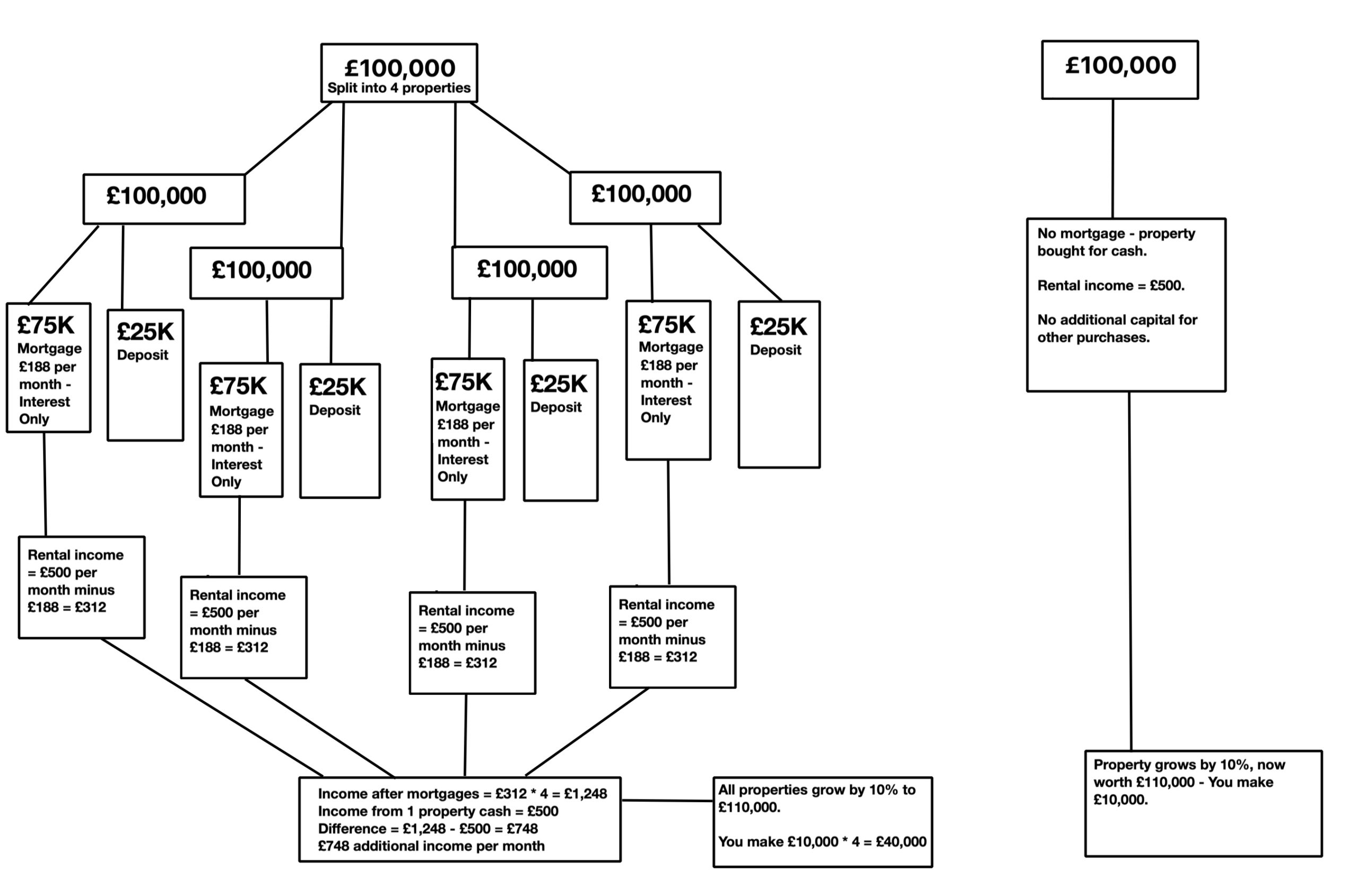

From left to right this shows 2 possible routes. It shows how you could split £100,000 into 4 properties, each geared (with a mortgage), then what it would look like if you bought only one property without gearing (without a mortgage). In this example each property is worth £100,000 and will generate a rental income of £500 per month.

You’ll see that gearing you could make an additional £30,000 in capital value and an additional £748 per month.

It’s a no brainer really.

If property prices continue to increase, you can continue to withdraw capital from the properties you own to facilitate another purchase. It then starts to snowball.

The Risk

As with any investment based product there is risk involved, and here, it is specifically related to the debt.

- You have debt to pay back, and will be expected to pay the mortgage payments even if you aren’t getting any rental income.

- You will have to pay back the entire mortgage balance.

- There is rental void risk where you may have a period of time without a tenant. However, having multiple property income streams should help cover if one doesn’t have a tenant.

- In the picture above, the opposite could happen. Should house prices drop 10% you could end up losing £40,000 in value compared to £10,000.

You have to weigh up the risks and the gains and decide whether you are comfortable with these risks.