Bitcoin, a type of digital money, might seem confusing at first. But don’t worry, we’ll break it down for you. In this post, we’ll ask the question, what is Bitcoin? How to navigate the risks, and more.

Where Did Bitcoin Come From?

Back in 2008, a mysterious figure using the name Satoshi Nakamoto introduced Bitcoin to the world. Satoshi’s real identity remains unknown, adding to the intrigue surrounding the origins of this digital currency.

Satoshi’s motivation was clear: they aimed to create a form of money that operated independently of governments and traditional financial institutions. This revolutionary idea marked the birth of cryptocurrency, a ground breaking concept that would redefine the way we think about money and transactions.

Satoshi’s vision laid the foundation for a decentralised financial system, one where individuals could have more control over their wealth and transactions without relying on centralised authorities.

Thus, Bitcoin emerged as a symbol of financial freedom and technological innovation, setting the stage for the rise of a new era in digital finance.

Understanding Bitcoin

Understanding Bitcoin goes beyond simply thinking of it as digital cash. Unlike physical money that you can hold in your hand, Bitcoin exists solely in the digital realm. It’s a form of currency that resides on the internet, stored in digital wallets rather than physical wallets. What makes Bitcoin unique is its underlying technology, known as blockchain.

Blockchain

Blockchain is a revolutionary system that serves as the backbone of Bitcoin and many other cryptocurrencies. Think of it as a digital ledger that records all transactions made with Bitcoin. However, unlike traditional ledgers controlled by banks or governments, the blockchain is decentralised. This means that instead of being stored in a single location, copies of the blockchain are distributed across a network of computers worldwide.

Every transaction made with Bitcoin is recorded on the blockchain in a secure and transparent manner. Each block in the chain contains a list of transactions, and these blocks are linked together in chronological order. This ensures that every Bitcoin transaction is traceable and cannot be tampered with.

The blockchain is maintained by a network of computers, known as nodes, which work together to validate and confirm transactions. This process, known as mining, involves solving complex mathematical puzzles to add new blocks to the blockchain. Miners are rewarded with newly created bitcoins for their efforts, incentivising them to participate in the network and secure the system.

So, while Bitcoin may seem abstract compared to physical cash, its foundation on blockchain technology makes it a powerful and revolutionary form of digital currency.

Getting Bitcoin

There are various avenues for interested individuals to acquire this digital currency. One common method is purchasing Bitcoin through specialised websites known as cryptocurrency exchanges, like Coinbase.

These platforms facilitate the buying and selling of Bitcoin, allowing users to exchange traditional currency, such as pounds or dollars, for Bitcoin at current market rates.

For those with technical skills and access to the necessary equipment, mining is another option for acquiring Bitcoin.

Using Bitcoin

Bitcoin offers a convenient and versatile way to engage in financial transactions, much like using traditional currency online. With Bitcoin, you can seamlessly conduct various activities, from purchasing goods and services to sending money to friends and family members, all through the use of your computer or smartphone.

One of the primary uses of Bitcoin is as a medium of exchange for buying goods and services. Many online retailers and businesses now accept Bitcoin as a form of payment, allowing you to shop for a wide range of products and services using your Bitcoin balance.

Dealing with Risks

Bitcoin, despite its numerous benefits, it is not immune to potential pitfalls. One of the most significant risks associated with Bitcoin is its price volatility.

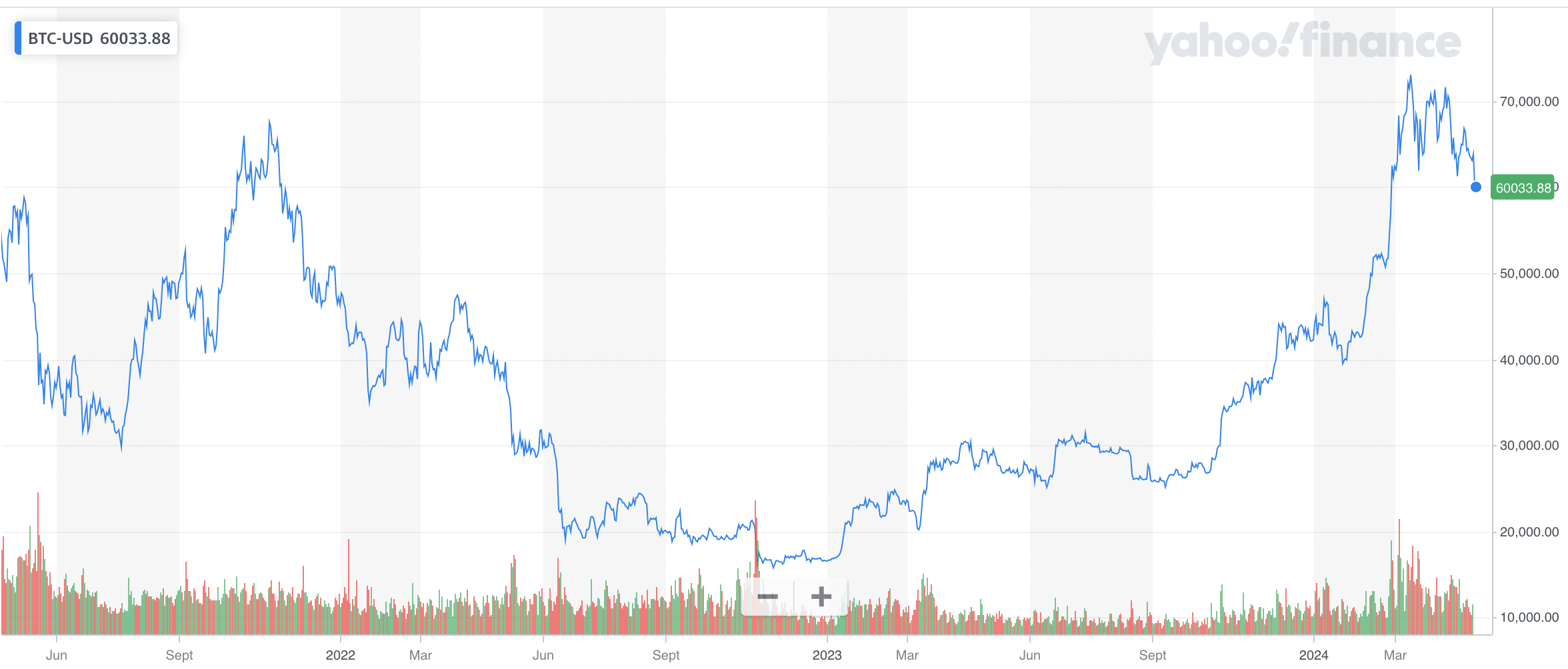

Unlike traditional currencies, which tend to have relatively stable values, the price of Bitcoin can fluctuate dramatically over short periods. This volatility can result in significant gains for some investors but also substantial losses for others. Therefore, it’s essential to be prepared for price fluctuations and only invest what you can afford to lose. Just look at the price change below.

Another risk to consider is the potential for theft or loss of Bitcoin. Since Bitcoin transactions are irreversible, once funds are sent, they cannot be retrieved unless the recipient voluntarily returns them. This lack of recourse makes Bitcoin susceptible to hacking, scams, and fraudulent schemes.

Cybercriminals may target cryptocurrency exchanges, online wallets, or individual users to steal Bitcoin, emphasising the importance of employing robust security measures to protect your digital assets.

Is Bitcoin a Good Idea for You?

Carefully considering various factors is necessary to determine if Bitcoin is a suitable investment for you. Some individuals find Bitcoin appealing due to its impressive price appreciation over time. However, it’s crucial to understand that investing in Bitcoin comes with risks.

One of the primary reasons people consider investing in Bitcoin is its track record of substantial price growth. Since its inception, Bitcoin has experienced significant price volatility, with periods of rapid appreciation followed by sharp declines. Some investors see this volatility as an opportunity to generate substantial returns over the long term.

However, it’s essential to acknowledge that investing in Bitcoin is speculative and inherently risky.

The cryptocurrency market is highly volatile and can be influenced by factors such as market sentiment, regulatory developments, technological advancements, and macroeconomic trends. As a result, the value of Bitcoin can fluctuate unpredictably, potentially leading to losses for investors.

Before investing in Bitcoin or any other cryptocurrency, carefully assess your risk tolerance and financial situation. Investing in Bitcoin should be seen as a high-risk, high-reward proposition, and you should only allocate funds that you can afford to lose entirely. Additionally, diversifying your investment portfolio can help mitigate risk and safeguard against potential losses.

How Does Bitcoin Make Money?

One way Bitcoin makes money is through trading and investing. Similar to traditional financial markets, Bitcoin can be bought and sold on cryptocurrency exchanges, where its price is determined by supply and demand dynamics.

Traders aim to profit from short-term price fluctuations by buying low and selling high, while long-term investors may hold onto Bitcoin with the expectation of future price appreciation. This speculative activity contributes to trading volumes and liquidity in the Bitcoin market, influencing its overall value.

As more businesses accept Bitcoin as a form of payment, its adoption and usage increase, further bolstering its value. Furthermore, Bitcoin’s limited supply, with a maximum of 21 million bitcoins set to ever be created, contributes to its scarcity and deflationary nature, potentially driving up its value over time.

Understanding Rules and Laws

Anyone engaging with cryptocurrency must understand the rules and laws surrounding Bitcoin. The regulatory landscape for Bitcoin varies significantly from one country to another, with some nations embracing its potential while others take a cautious or restrictive approach.

In countries where Bitcoin is embraced, regulations often support its use and adoption. These jurisdictions provide clear guidelines for businesses and individuals on buying, selling, and using Bitcoin. As a result, users in these countries can confidently transact with Bitcoin, knowing they comply with the law.

Conversely, some countries take a cautious or restrictive stance towards Bitcoin. They may impose stringent regulations or outright bans on certain aspects of Bitcoin usage, such as trading, mining, or accepting it as payment. In such environments, users may encounter challenges accessing cryptocurrency exchanges or obtaining banking services for Bitcoin-related activities.

Ultimately, dealing with Bitcoin requires compliance with local laws and regulations.

Wrapping Up

As we wrap up, it’s important to emphasise that while Bitcoin may initially appear complex, it’s entirely feasible to grasp its concepts and navigate with relative ease. By following a few fundamental principles, you can embark on your journey with confidence and clarity.

Firstly, approach Bitcoin with caution and prudence. Take the time to understand its fundamentals, including how it works and its potential risks.

Secondly, conduct thorough research before diving into Bitcoin. Explore reputable sources of information, such as educational resources, reputable news outlets, and trusted community forums. By arming yourself with knowledge, you’ll be better equipped to navigate the complexities of the cryptocurrency landscape and make good investment choices.

Lastly, only invest what you can afford to lose, and avoid risking more than you’re comfortable with. While Bitcoin has the potential for significant returns, it’s important to approach it with a realistic mindset and a long-term perspective.

With these principles in mind, you can confidently explore the world of Bitcoin and determine if it aligns with your financial goals and risk tolerance. Whether you’re intrigued by its technology, interested in its investment potential, or simply curious to learn more, Bitcoin offers a world of possibilities for those willing to explore it with an open mind and a cautious approach.