Pensions play a crucial role in securing our financial future, especially as we approach retirement age. With state pensions becoming less effective, private pensions are becoming more and more important. Understanding how pensions function, including their benefits, tax implications, and setup process, is essential for effective retirement planning. How do pensions work? Your ultimate guide to understanding pensions is here.

How do Pension Work?

Pensions are a long-term savings vehicle designed to provide a steady income stream in retirement. Pensions are tailored to last during retirement, ensuring financial stability and peace of mind well beyond employment.

Private Pensions

Private pensions, often referred to as personal pensions, play a pivotal role in retirement. These pensions are entirely different to state pensions, as they are either personally arranged or through employers. This autonomy offers you greater control over your retirement, allowing you to tailor your investment strategies to your personal needs and circumstances.

Workplace pensions, provided by employers, offer a convenient avenue for savings accumulation, often bolstered by employer contributions.

For those seeking further flexibility and control, self-invested personal pensions (SIPPs) offer a breadth of investment options and opportunities, often not found in other pension contracts.

Tax Relief

One of the standout benefits of pensions is their tax efficiency.

Contributions made to pension schemes qualify for tax relief, effectively reducing the amount of income tax you pay on your earnings. This tax relief is calculated based on your income tax rate, providing a valuable incentive to prioritise pension contributions.

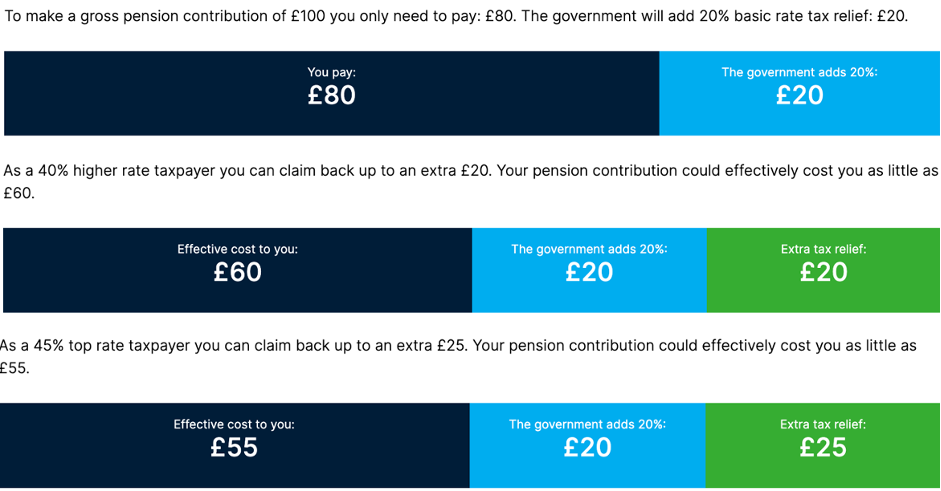

If you wanted to make a gross contribution to a pension of £100, you would need to put in £80 and you get the remaining £20 back in tax relief. Depending on your tax bracket you could claim back more.

Remember you need to claim back the extra tax relief from HMRC! It’s not added to the pension.

Investment Growth Potential

Pensions offer you the opportunity to harness the power of investment growth to build a substantial retirement fund.

Unlike traditional savings accounts, which may yield modest returns, pension funds can be invested in a diverse range of assets, including stocks, bonds, and property. Over the long term, these investments have the potential to generate significant returns, thereby bolstering the value of pension savings.

By leveraging the expertise of investment professionals and adopting a diversified investment strategy, you can maximise the growth potential of your pension funds, ultimately enhancing your financial security in retirement.

Employer Contributions

For those of you enrolled in workplace pension schemes, employer contributions represent a valuable additional benefit.

Many employers offer matching contributions to employee pension contributions, increasing the amount saved. This employer contribution not only accelerates the growth of pension savings but also amplifies the overall value of the retirement fund. By taking full advantage of employer contributions, you can significantly bolster your retirement nest egg.

Financial Security in Retirement

Perhaps the most significant benefit of a pension is the ability to provide financial security and peace of mind in retirement.

By contributing to a pension scheme throughout your working life, you can build a robust retirement fund that serves as a reliable source of income in later life. This financial cushion not only affords retirees the freedom to pursue their passions and interests but also shields them from the financial uncertainties that may arise during retirement.

Annual Allowance

The annual allowance serves as a crucial limit in pension planning, dictating the maximum amount you can contribute to your pension each year, while still benefiting from tax relief.

For most, the annual allowance is 100% of your earned income up to £60,000. However, it’s important to note that this allowance may be subject to tapering rules for higher earners, potentially reducing the available contribution limit.

If you’re looking to boost your pension savings beyond the annual allowance, carry forward rules offer a valuable opportunity to make use of unused allowance from previous years. You can carry forward any unused annual allowance from the previous three tax years, making your contribution much larger – this tends to only work for very high earners though.

Setting Up a Pension

Choosing the Right Pension Scheme

Whether opting for a workplace pension provided by your employer, a personal pension arranged independently, or a self-invested personal pension (SIPP), it’s essential to assess the features, benefits, and investment options of each scheme carefully.

By conducting thorough research and seeking expert advice, you can make an informed decision about what is right for you.

The Setup Process

Once you’ve chosen a pension scheme that meets your requirements, the setup process typically involves completing the necessary paperwork and providing relevant personal information to establish your pension account. This may include details such as your name, date of birth, National Insurance number, and employment status.

Depending on the type of pension scheme selected, you may also need to designate beneficiaries, choose investment options, and specify contribution levels.

While the setup process may vary depending on the pension provider, guidance and support are often available to streamline the process.

Making Regular Contributions

With your pension account established, the next step is to begin making regular contributions. Contributions can be made through various channels, including payroll deductions for workplace pensions, direct debits for personal pensions, or one-off payments.

It’s important to set a contribution level that aligns with your financial circumstances and retirement goals, ensuring consistent saving and steady growth of your pension fund. By prioritising pension contributions as part of your overall financial plan, you can take proactive steps towards achieving financial security in retirement.

Monitoring and Adjusting Your Strategy

Setting up a pension is not a one-time event but rather an ongoing process that requires regular monitoring and adjustment to ensure alignment with changing circumstances and objectives.

As life circumstances evolve, such as changes in employment, income levels, or family responsibilities, it’s essential to review your pension strategy periodically and make the necessary adjustments. This may involve increasing contribution levels, diversifying investment options, or revising retirement goals in response to shifting priorities.

By remaining proactive and engaged in your pension planning, you can adapt to changing circumstances and stay on track towards achieving your retirement goals.

Accessing Your Pension

Reaching the Retirement Milestone

Accessing your pension marks a significant milestone in your financial journey, signalling the transition from saving for retirement to enjoying the fruits of your labour in later life.

As you approach retirement age, it’s essential to understand the options available for accessing your pension savings and crafting a strategy that aligns with your retirement goals and lifestyle preferences. Whether you’re seeking a lump sum payment to fund a specific goal or looking to secure a steady income stream throughout retirement, navigating the process of accessing your pension requires careful consideration and planning.

Retirement Income Options

Upon reaching retirement age, you have a range of options for accessing your pension savings, each offering unique advantages and considerations.

One common option is to take a tax-free lump sum of up to 25% of your pension pot, which provides an immediate influx of cash. Alternatively, you can choose to convert your pension savings into a regular income through options such as annuities or income drawdown.

Annuities offer a guaranteed income for life, providing stability and peace of mind in retirement, while income drawdown allows you to retain control over your pension savings and make flexible withdrawals as needed.

Tax Implications

While accessing your pension savings provides financial flexibility and freedom in retirement, it’s essential to consider the tax implications of your chosen withdrawal strategy carefully.

While the tax-free lump sum is not subject to taxation, any additional withdrawals from your pension are taxed as income at your marginal tax rate. This means that large withdrawals could potentially push you into a higher tax bracket, resulting in increased tax liabilities.

By understanding the tax implications of different withdrawal options and planning strategically, you can minimise the tax liability.

Maximising Pension Flexibility

Pension flexibility rules introduced in recent years have enhanced a person’s ability to access their pension savings. These rules allow you greater flexibility in how you access your pension funds.

Whether opting for phased withdrawals, lump sum payments, or a combination of both, pension flexibility rules offer you greater control over your retirement income and expenditure, providing peace of mind and financial security in later life.

Tax on Death Benefits

It’s also essential to consider the tax implications of pension death benefits when planning your estate and legacy. While pensions can be passed on to beneficiaries tax-free if the pension holder dies before the age of 75, any withdrawals made by beneficiaries after 75 may be subject to income tax at the beneficiary’s marginal tax rate.

By understanding the tax treatment of pension death benefits and incorporating this into your estate planning, you can ensure that your loved ones receive maximum value from your pension savings while minimising tax liabilities.

Seeking Professional Advice

Given the complexities of pension taxation and the potential impact on retirement income, seeking professional advice from a qualified financial adviser is highly recommended. An adviser can help you navigate the intricacies of pension taxation, develop a tailored tax-efficient withdrawal strategy, and optimise your retirement income to achieve your financial goals.

With expert guidance and careful planning, you can start pension withdrawals with confidence and peace of mind, ensuring a secure and prosperous retirement for years to come.

Conclusion

Understanding how pensions work is vital for effective retirement planning. From tax relief and pension allowances to setting up a pension and accessing funds in retirement, there are various aspects to consider.

By taking advantage of tax relief, making informed decisions about contributions, and understanding the tax implications of withdrawals, you can effectively plan for a secure and comfortable retirement.

It’s advisable to seek professional financial advice tailored to your circumstances to maximise the benefits of your pension savings.