As a parent, you want the best for your child, and ensuring their financial security is undoubtedly part of that equation. You may find yourself asking, what is the best way to save and invest for my child’s future.

The journey of securing your child’s financial future involves careful planning, smart saving strategies, and savvy investing. In the UK, there are various options available to parents looking to save and invest for their children, from Junior ISAs (JISAs) to pension contributions.

Junior ISAs (JISAs)

One of the most popular options for saving and investing for children in the UK is through Junior ISAs.

These tax-efficient accounts allow parents to save up to a certain amount each year (£9,000 as of 2024) on behalf of their child.

The beauty of JISAs lies in their tax-free status, meaning any interest or returns earned within the account are shielded from income tax and capital gains tax.

By contributing regularly to a JISA, you’re not only building a nest egg for your child’s future but also harnessing the power of compound growth. Compound growth is where your investment earns returns, which are then reinvested to generate even more returns.

Over time, this compounding effect can significantly boost the value of your child’s savings.

Pension Contributions for Children

While pension contributions for children may seem like a forward-thinking strategy reserved for adults, they offer a unique opportunity to supercharge your child’s financial future from an early age.

In the UK, children can have a pension set up in their name from birth, presenting parents with a powerful tool to kickstart their child’s retirement savings journey.

But why consider pension contributions for children? The answer lies in the concept of time and the remarkable potential it holds for long-term investments.

By starting early, you’re giving your child’s pension fund decades to grow and compound, potentially resulting in a substantial retirement pot by the time they reach retirement age.

Here’s how it works

When you make pension contributions for your child, those contributions are invested in a pension fund, which, in turn, is managed by pension providers. These funds are typically diversified across a range of assets, including stocks, bonds, and property, with the aim of generating growth over the long term.

One of the most compelling reasons to consider pension contributions for children is the tax benefits they offer.

In the UK, pension contributions qualify for tax relief, meaning that for every pound you contribute to your child’s pension, the government adds tax relief at the basic rate (currently 20%). This effectively boosts your contributions, helping your child’s pension fund grow even faster.

The maximum you can pay into the pension is £2,880 per year, with the tax relief on top your child will have £3,600 going into the pension every year.

Valuable Teaching Tool

Moreover, pension contributions for children can serve as a valuable teaching tool, instilling the importance of saving for the future from an early age.

By involving your child in discussions about their pension fund and the power of compound growth, you’re equipping them with essential financial literacy skills that will serve them well throughout their lives.

It’s essential to consider the long-term nature of pension investments and the fact that funds contributed to a pension are locked away until your child reaches retirement age. While this means that the money isn’t accessible for other purposes, it also ensures that your child’s retirement savings remain intact and continue to grow undisturbed over the years.

Harnessing the Power of Compound Growth

Compound growth is the magical force that can turn small, regular contributions into a substantial nest egg over time. The concept is simple yet incredibly powerful: when your investments generate returns, those returns are reinvested, leading to exponential growth.

This snowball effect can significantly amplify the value of your child’s savings and investments, especially when you start early and remain consistent.

Let’s break down the mechanics of compound growth with an example.

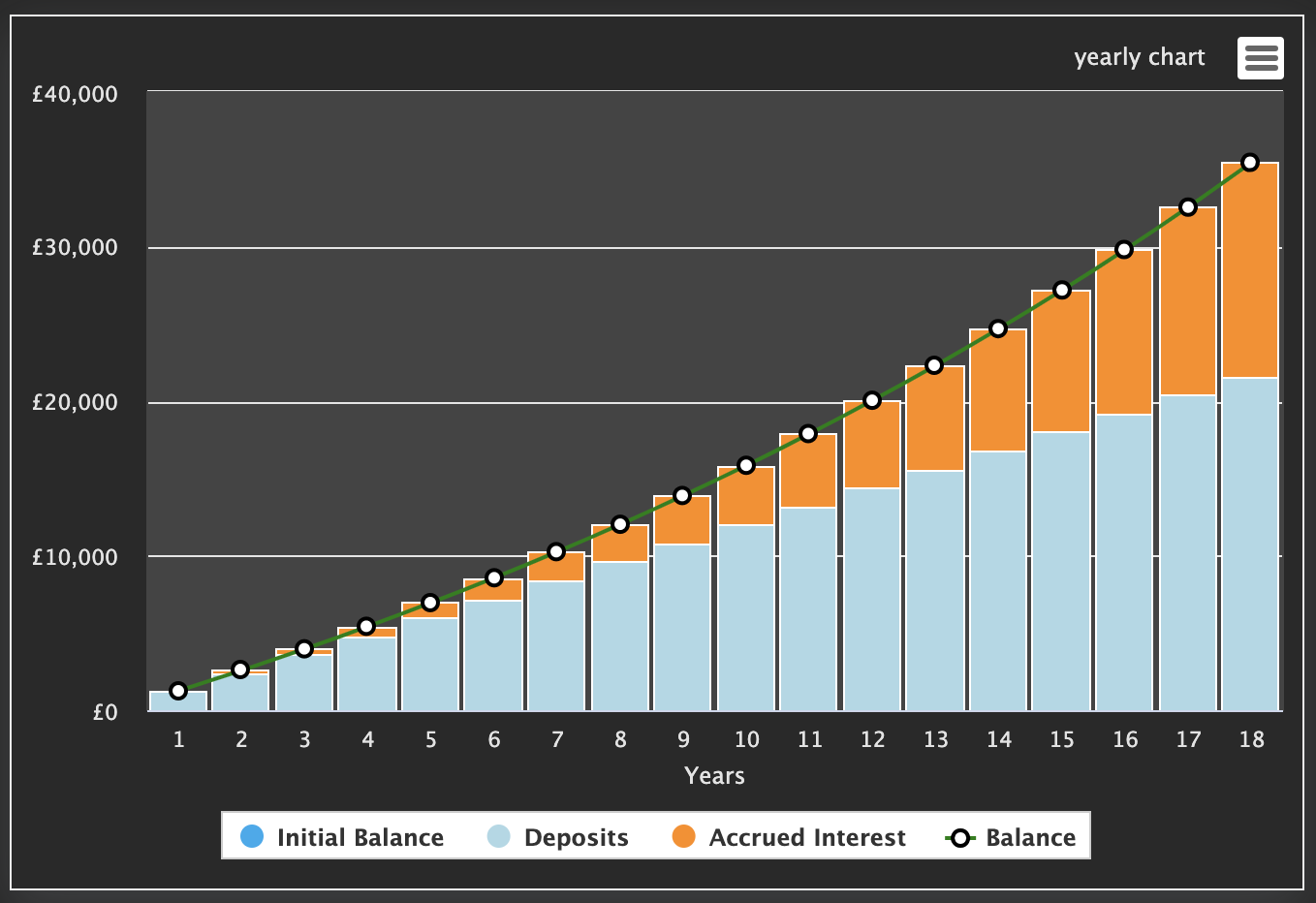

Suppose you begin investing £100 per month in a Junior ISA for your child from the day they are born, and you continue this monthly contribution until they turn 18. Assuming an average annual return of 5%, let’s see how compound growth works its magic:

- Year 1: You’ve invested £1,200 (£100 per month), and with a 5% return, your investment grows to £1,260.

- Year 5: Your total contributions amount to £6,000, but thanks to compound growth, your Junior ISA is now worth approximately £6,962.

- Year 10: With a decade of consistent contributions and compound growth, your investment has ballooned to around £15,848, exceeding your total contributions (£12,000) by a significant margin.

- Year 18: By the time your child reaches adulthood, your Junior ISA could potentially be worth over £35,000, all from your cumulative contributions of £21,600.

If you find pictures easier

This illustration demonstrates the power of starting early and allowing time for compound growth to work its wonders. Even modest monthly contributions can grow into a substantial sum over the long term, providing your child with a solid financial foundation for their future endeavours.

Compound growth isn’t limited to Junior ISAs. Whether you’re investing in stocks, bonds, mutual funds, or other assets on behalf of your child, the principle remains the same: reinvesting returns leads to exponential growth over time.

By consistently reinvesting dividends, interest, or capital gains, you’re harnessing the full potential of compound growth to propel your child’s financial well-being forward.

It’s important to note that while compound growth is a powerful wealth-building tool, it requires patience, discipline, and a long-term perspective. Short-term fluctuations in the market are inevitable, but staying the course and remaining invested through market ups and downs can yield significant rewards over time.

Tax Implications for Parents

It’s essential to be aware of the tax implications for parents when saving and investing for their child’s future. While contributions to JISAs and pensions come with tax benefits, any income generated outside of these tax-advantaged accounts may be subject to taxation on you, the parent.

For instance, if you choose to invest in stocks, bonds, or other taxable investments on behalf of your child, any dividends, interest, or capital gains earned may be subject to income tax or capital gains tax, depending on the amount and your tax status.

Conclusion

When it comes to saving and investing for your child’s future in the UK, Junior ISAs, pension contributions, and the power of compound growth are potent tools at your disposal. By leveraging these strategies wisely and staying informed about tax implications, you can set your child on a path towards financial security and prosperity for years to come.

Remember, the key is to start early, be consistent, and seek professional financial advice when needed.